Treasury software for SMEs

The multi-bank and cash management software, Cegid Exabanque, helps you manage and optimize your treasury: forecast balances, investments and financing, use of macros for current requests, etc.

Manage your forecasts efficiently

The Cegid Exabanque multi-banking treasury management program enables effective management of your treasury.

Equipped with numerous automatic mechanisms and simple ergonomics, Cegid Exabanque allows you to limit your costs by:

- Predict your treasury needs or surpluses

- Share your availability between your banks or between your companies

- Optimise your investments and loans

To simplify the implementation of the treasury module in Cegid Exabanque, we provide you with a default configuration (transaction code and budgetary code table, profile for integrating coded bank entries, etc.). Simple, quick and easy, you just have to initialize your treasury accounts to get started.

Improve your visibility and optimise your liquidity

Thanks to Cegid Exabanque’s treasury management functions created in partnership with company treasurers, you can improve your visibility and optimise your liquidity thanks to the following benefits:

- Manage your forecasts

- Optimise your treasury

- Macros

Manage your forecasts

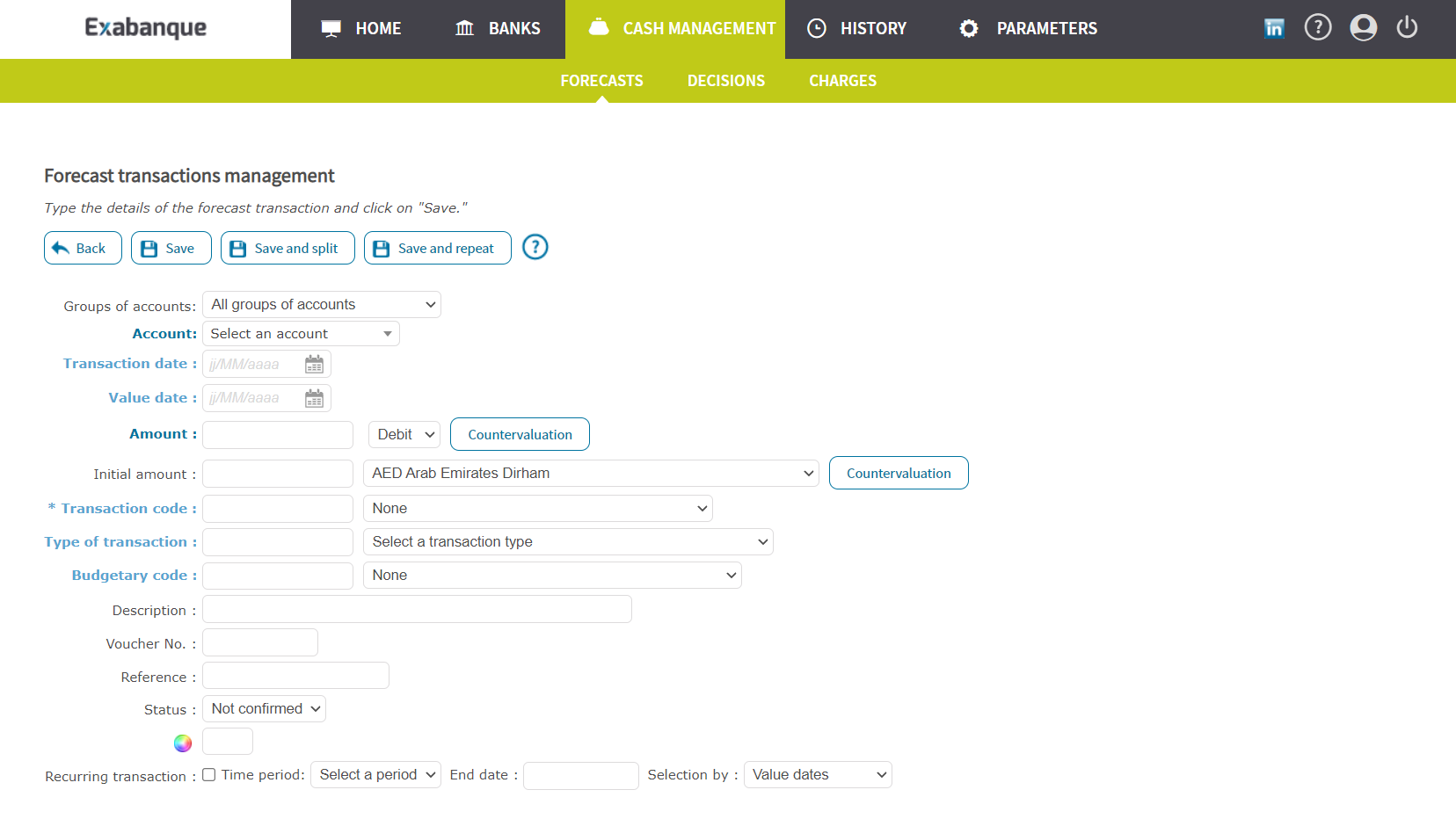

With Cegid Exabanque, updating your forecasts is made easier through 3 different ways of creating projected entries:

- Entry of single or repetitive operations (frequency and duration configurable)

- Automatic registration when sending a bank remittance or when registering your investments and financing

- Importing text files with separators

Cegid Exabanque automates your forecasts management

You generate your forecasts at transaction date, and Cegid Exabanque automatically calculates the value date, according to the configuration of your banking conditions.

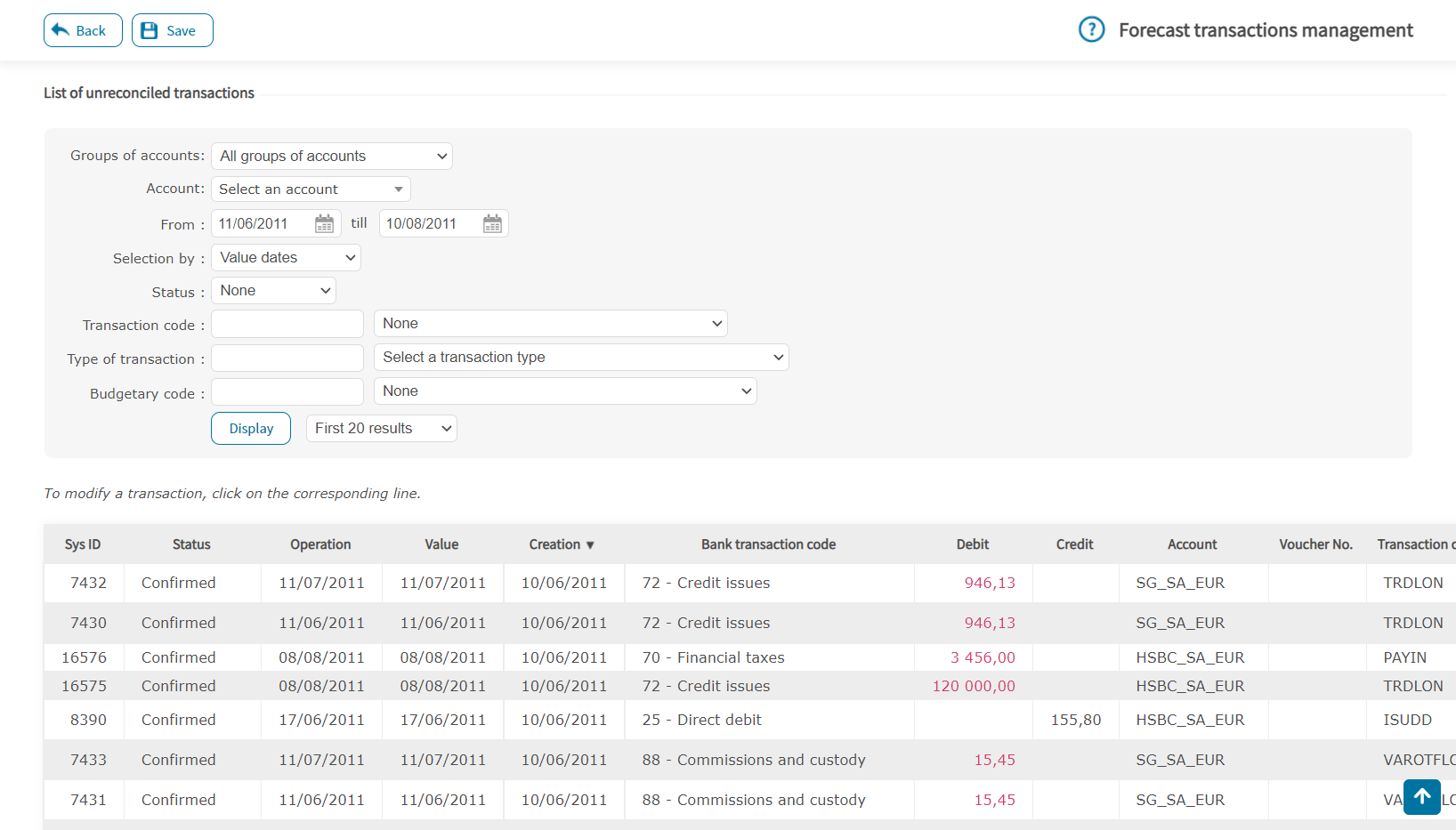

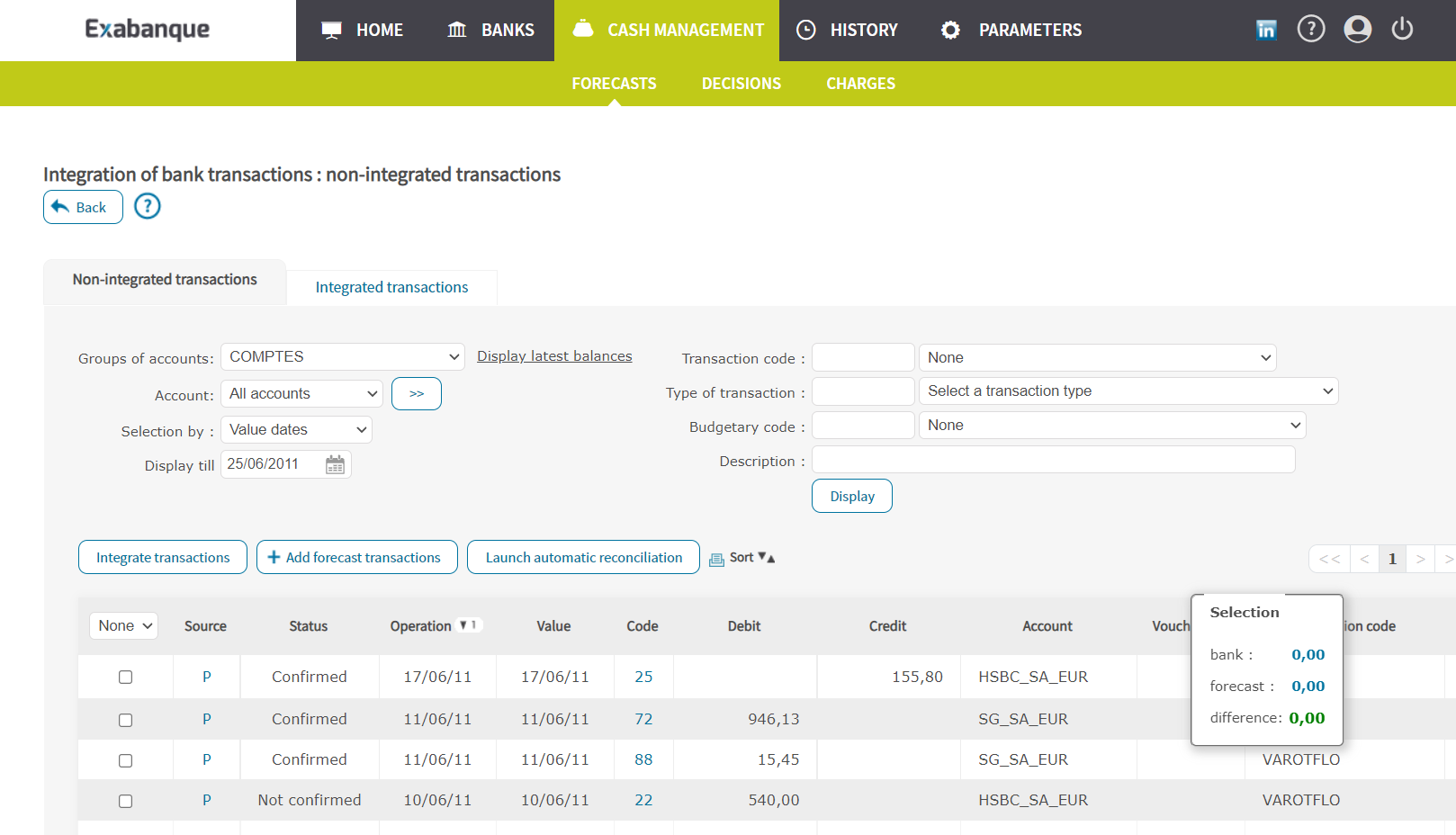

Reconcile your entries and your forecasts:

- One-time reconciliation

- Batch reconciliation (1 forecast = N banking entries) with the calculation of the difference at the end of the reconciliation automatically carried over (+/-) to the following batch forecast

- Automatic reconciliation: set your own reconciliation rules (labels, amounts, dates, and so on)

- Manual reconciliation: process your last unrecognised entries manually

Modify your forecasts

Breakdown of batch forecasts, date deferral, amounts, status, etc.

View your forecast statement at any time

- View your forecast statement at any time

- In consolidated form

You remain in control of the data processed in Cegid Exabanque,

the extraction of your forecasts is available in Excel and PDF format.

Optimise your treasury

Cegid Exabanque assists you with your arbitration choices: transfer, investment, appeal for funds.

Forecasting and balancing

With the Cegid Exabanque software, you can view your forecast balances by consolidating them into personalised groups of accounts:

- by company

- by bank

- by currency

You therefore have both the calculation and the visual representation of your value balances.

Using this summary, you can run calculations of your treasury balancing. If you are happy with the calculation, you can send your treasury transfers directly to the bank.

Investments and financing

To optimise your treasury, you can monitor your investments and financing, filed according to type, using the following features of the Cegid Exabanque program:

- Term deposits

- Enter your mutual fund portfolio

- Portfolio tracking calculated according to the FIFO method (first in, first out)

- Management of value dates

- Entry and import of exchange rates

- Calculation of unrealised capital gains

- Term loans

- Buying and selling of currency, production of confirmation slips

Each of these modules enables you to generate projected entries for investments and financing: due dates, interest and bank charges.

Transaction analysis by transaction type and budgetary codes

Codifying your banking transactions allows you to monitor forecasts and operations in the manner of your choosing, in detail, as well as document developments relating to an account or group of accounts.

With Cegid Exabanque, you can:

- Create your transaction types and budgetary codes

- View and display your personalised forecasts by a given frequency

- Issue the detailed record of your projected transactions in Excel or PDF format

Transaction types and budgetary codes are attributed to banking transactions in one of two ways:

- At point of reconciliation: the transaction takes on the analytical codification attributed to the forecast

- Automatic attribution upon receipt of account statements

You therefore receive an analytical report of your forecasts on a weekly, monthly or quarterly basis according to your expenditure and collections in order to be able to analyse variations in your balances.

Treasury management in Cegid Exabanque

Record your forecasts in Cegid Exabanque and reconcile them with your banking transactions.

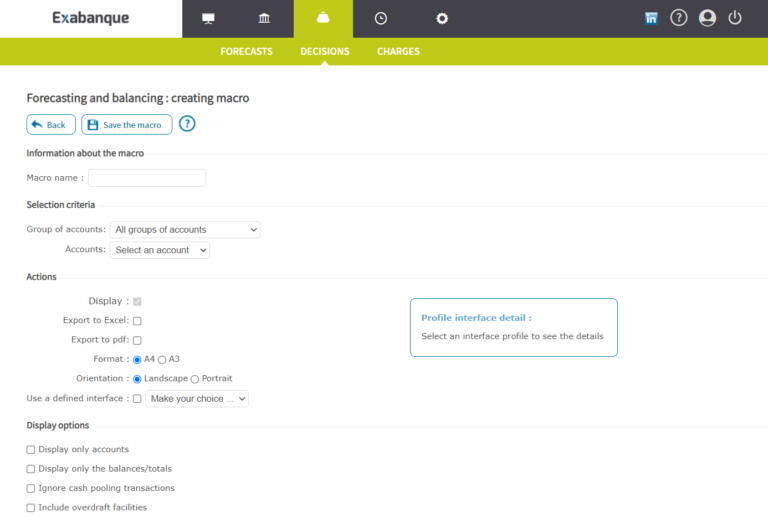

Eliminate repetitive tasks through the use of macro-commands

In Cegid Exabanque, you can use macro-commands to save your most frequent requests and the method by which your data leaves the program. This means you can avoid making recurrent entries and selections. In a single click you can…

- Generate entry logs

- Modify/delete forecasts (date deferrals, etc.)

- View your forecasts and balancing

- Display your forecasts by transaction type or budgetary code

- Generate all of your PDF or Excel reports at the same time

With Cegid Exabanque, updating your forecasts is made easier through 3 different ways of creating projected entries:

- Control of banking charges

- Analytical monitoring of treasury transactions

- Liquidity management