Exalog joins Cegid

Cegid confirms acquisition of Exalog, a specialized editor of treasury management software in SaaS mode. Cegid thereby strengthens its offering in treasury, ERP and tax, providing a complete financial suite to meet the needs of Finance departments, from SMEs to key accounts

- Banking Communication

- Treasury

- Accounting reconciliation

- Mobile app

- Automation of transactions

Make your SEPA payments and direct debits

Depending on their issues and needs, Cegid Exabanque users can use EBICS or FTPS communication protocols to exchange payment files with their banks.

Cegid Exabanque is compatible with the SEPA format used by all European banks for payments and direct debits.

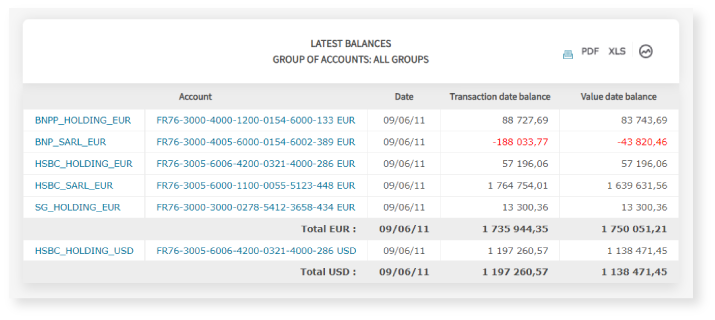

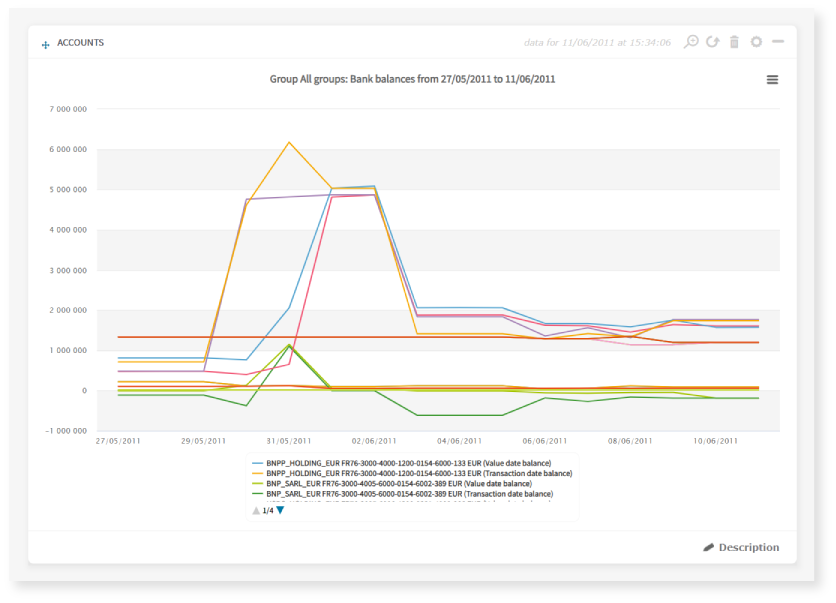

Optimize your treasury management with an advanced and user-friendly application

Cegid Exabanque helps you manage and optimize your treasury: forecast balances, investments and financing, use of macros for common queries, etc.

Your banking reconciliation carried out automatically

The Cegid Exabanque accounting reconciliation module automates the lettering of your banking entries (for SEPA payments and collections: SCT and SDD) in order to improve the reliability of your accounts.

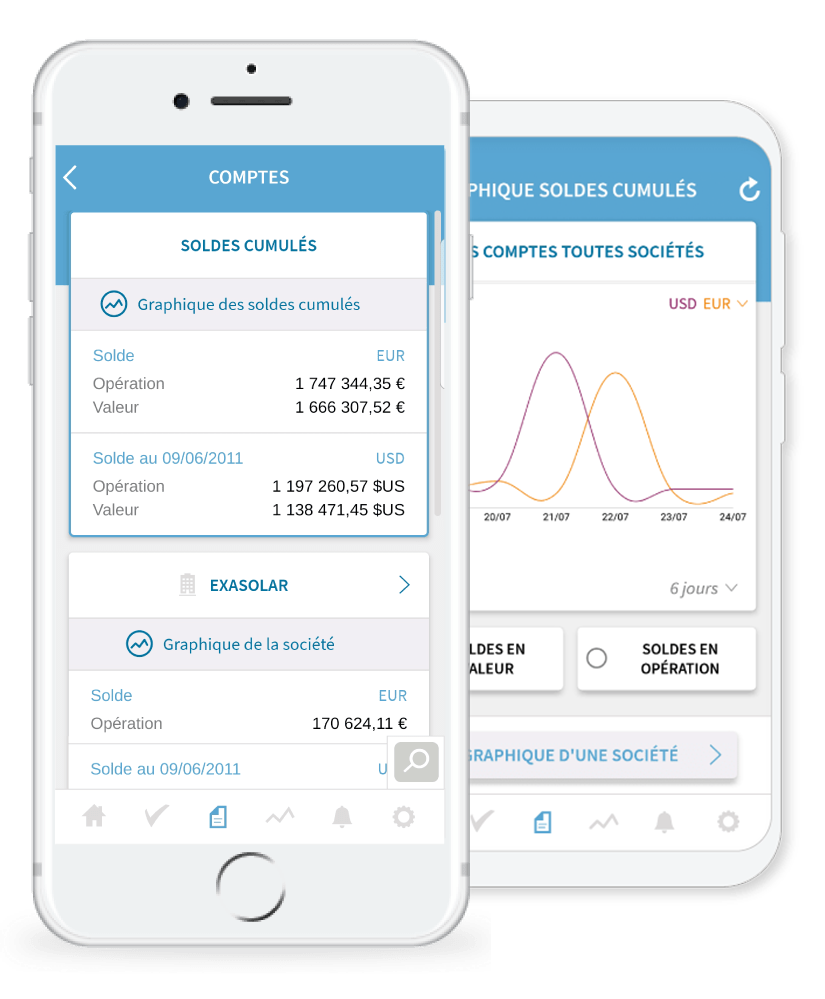

Follow your banking operations on Exabanque Mobile

Cegid Exabanque goes everywhere with you thanks to its mobile application available on Android and iPhone. On Exabanque Mobile, you can manage your day-to-day banking operations in real time: checking remittances and balances, receiving account statements, validating banking orders, personalized alerts and Push notifications, etc.

Automate your transactions

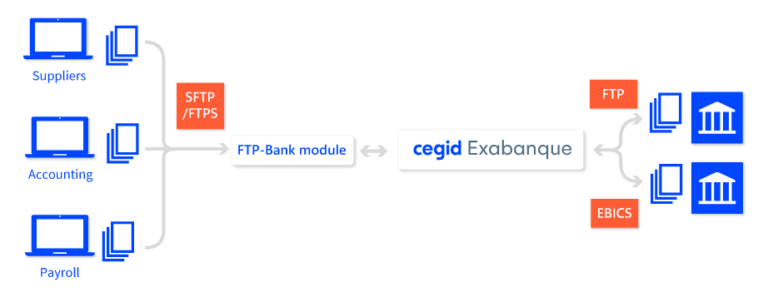

Cegid Exabanque, the multi-banking treasury management software, interfaces with your existing IT system using two different options.

The FTP-Bank option (ERP interface) allows you to automate your flows while the optional Accounting interface module allows you to generate and export your accounting entries.

FTP-Bank :

Synchronize Cegid Exabanque with your ERP

Accounting interface: generation of accounting entries

Benefits of Cegid Exabanque

Independent from your banks

Multiple banks

Fast set-up

A proven solution with more than 10,000 users

Digital signature

Assistance at no extra cost

No initial investment

Automatic free update

Reduced risk of fraud

No additional cost per user

News

PSD3: the European Commission’s response to market evolution

The payment services market has evolved significantly in recent years, with the number of electronic payments in the European Union continually increasing. New providers have

Cegid confirms acquisition of Exalog

Press Release Cegid confirms acquisition of Exalog Cegid, a European leader in cloud-based management solutions for professionals in finance (ERP, treasury, tax), human resources (payroll,

Cegid announces its intention to acquire Exalog

Press Release Cegid announces its intention to acquire Exalog, a specialized editor of treasury management software in SaaS mode Cegid thereby strengthens its offering in

We are still just as satisfied with the software now, one year on. Everything is hassle-free, which is largely thanks to the availability of Exabanque’s customer support teams and their advice.

One of the major benefits of Cegid Exabanque is how easy it is to use. Its ergonomics are so intuitive that a 12-year-old would be able to use it. It is also a reliable product. We haven’t really had any significant problems since we installed it.

Once the software had been set up, our users got to grips with it pretty quickly. It really is an easy and user-friendly tool. Cegid Exabanque is intuitive and adapted to everyday needs. The management of access rights is particularly efficient.

The favourable cost of Cegid Exabanque and the fact that it functions in SaaS mode were decisive factors for us, as well as how simple the interface is to use. as well as how simple the interface is to use.

There's nothing like a face-to-face discussion to help you understand what's at stake in your and present you with the solution that will meet your expectations.